2021 has been a remarkable year of economic recovery. Despite the spread of COVID variant Delta and supply chain disruption, the global economy has, to a large extent, demonstrated substantial progress. On the other hand, regulatory overhaul from Chinese authorities has added complexity to selected segments, resulting in volatilities in Chinese equity markets as one of the worst performing asset classes. We believe the 5 questions below are essential for investors to see how we envisage China may transition into a better year in 2022.

Key Insights:

- Recently, we have seen a significant shift from the Fed to a more aggressive monetary stance.

- Chinese government will continue to be nimble to further loosen if needed.

- China sovereign bonds are supported by index inclusion, attractive yield spread, and stable RMB appreciation.

- Given HSI’s current PB ratio is at ~1x, we believe that the downside risk for offshore Chinese equities is limited.

- We are turning more positive on Chinese equities on the back of potential monetary loosening, effective pandemic control, and compelling valuation.

1. What is the Fed’s latest stance and how does it affect Chinese equities and bonds?

The Fed’s tapering is one of the key events that we have been monitoring closely. Recently, we have seen the Fed’s significant shift to a more aggressive monetary stance, paving way for its acceleration in tapering timeline from US$15 billion to US$30 billion per month, as well as potentially three rate hikes by end of 2022. In particular, the Fed saw rapid progress on the US economy with close to full employment and also indicated its dedication to cope with the surge in inflation.

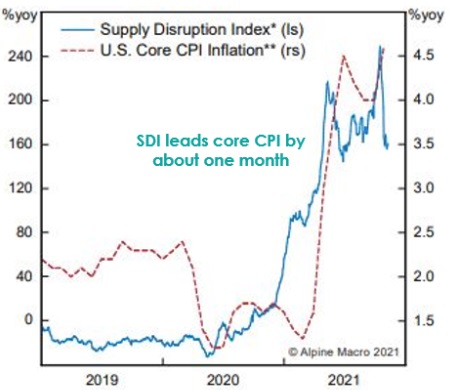

The graph below may give some hints on why the Fed is keen to deal with inflation. The Supply Disruption Index (SDI) summarizes the trend of raw material prices and shipping cost, and it serves as a leading indicator for core CPI in the downstream. Given the SDI index currently remains at high level, it is expected that core CPI would follow as well.

We believe whether tapering will cause dramatic market volatilities would depend on how well the Fed manages market expectations. So far, the market reacted positively to the change in stance, with no significant movements in treasury yields. Investors believe the US economy is heading to the right direction with a set of benign economic conditions, and the Fed is now ‘back on track’ to put everything in order.

Looking ahead, on the Fed’s developments, offshore Chinese equities tend to echo with the market sentiment in the US in the near term, but investors will normally refocus on the fundamentals over the longer term. On the other hand, onshore Chinese equities historically had a low correlation with other global markets, and thus, market performance will likely be quite independent to the US market. Lastly, Chinese (government) bonds will not have a significant impact with the Fed’s rate hikes given that China did not aggressively cut rates like what the US did, and thus, there is no need for China to do the rate normalization. Hence, China’s yield is expected to be relatively stable.

Supply Disruption Index (SDI) vs US Core CPI Inflation

* Includes prices of DRAM, German natural gas, Chinese thermal coal and containerized freight, Baltic Dry Index

** Excluding food & energy

Source: Alpine Macro, as at 15 Nov 2021

2. With the recent Reserve Requirement Ratios (RRR) cuts, will China continue to loosen its policy to support the economy?

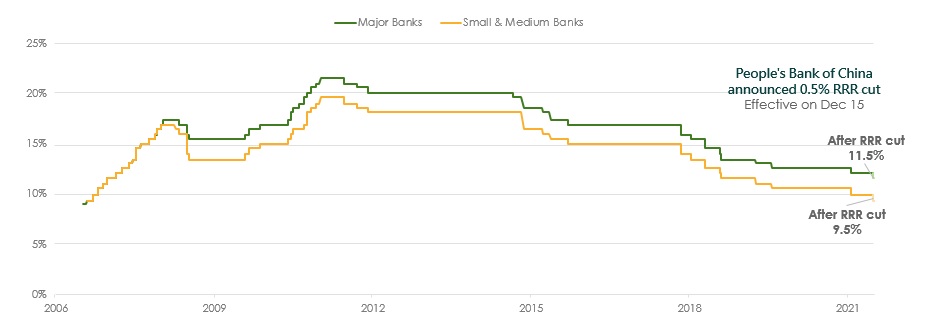

Likely – we expect the Chinese government will continue to be nimble and flexible to further loosen if needed. The recent RRR cut in December has further confirmed China’s change in monetary policy direction from tightening to loosening – due to the recent volatilities in the property market, the potential wave with the Omicron, or the relatively modest domestic demand figures.

China has different economic and monetary cycles as compared to the US. China was the first to enjoy a robust economic recovery since COVID and it only had one RRR cut since then. On the contrary, other developed countries, such as the US, heavily relied on rate cuts and asset purchases to support to economy. The bottom line is – the Chinese government has sufficient bullets to stabilize growth, which can be in the form of fiscal or monetary policies, ranging from further RRR cuts, rate cuts to medium-term lending facility rate reduction. In fact, the messages from China’s Central Economic Work Conference recently also revealed the government’s embrace in economic stability and support via fiscal/ monetary policies is one of the key focuses.

Reserve Requirement Ratios (RRR) of China

Source: Bloomberg, as of 9 Dec 2021

3. Is now a good timing to look into China sovereign bonds?

We are positive in China sovereign bonds, as supported by 3 favorable developments:

China’s index inclusion – integrating into global bond markets. After inclusions by Bloomberg and JPMorgan, the FTSE Russel World Government Bond Index, being the third index, has already begun its inclusion process in October this year. These inclusions, through a gradual process, will push China’s sovereign market further into the mainstream for international investors, translating into considerable inflows over the course and benefiting the onshore Chinese bond market as a whole. According to HSBC, US$130 billion of inflows could be expected, given China’s eventual 5.25% weighting in the FTSE Russell Index.

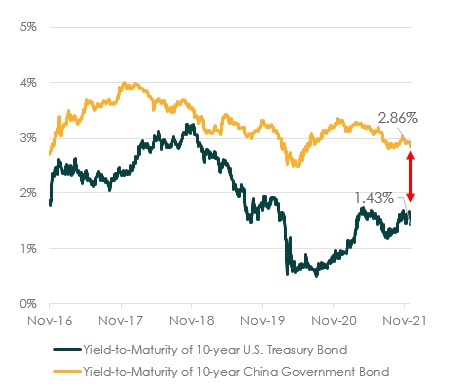

Attractive yield spread. The yield spread between China and US government bond remains to be wide, with the yield-to-maturity of 10-year China sovereign bond currently double of that of the US. Given that China did not aggressively cut rates like the way the Fed did, China’s yield level should be relatively stable looking ahead, and thus, continue to attract capital flows to China’s bond market.

Stable RMB appreciation. RMB currency has been on a steady appreciation since 2020, partly due to capital inflow in light of China’s robust economic recovery and the depreciation of other currencies from the expansionary monetary policies during the COVID pandemic. We expect this stable upward trajectory will continue to be supportive to RMB bonds.

Yield spread between China and U.S. Government Bond

Source: Bloomberg, as of 9 Dec 2021

4. Have Chinese equities bottomed?

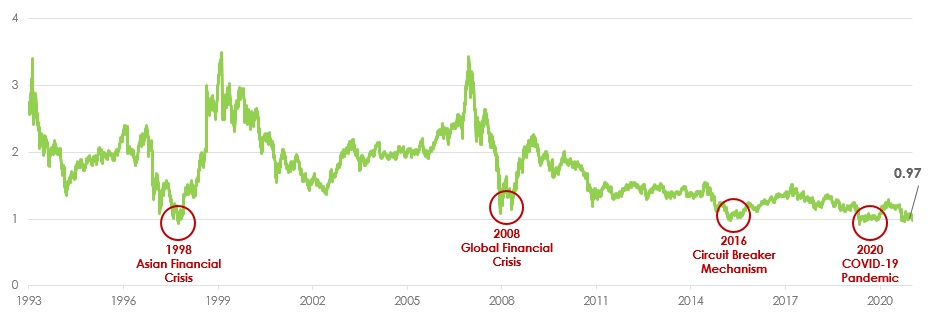

In 2021, Chinese equities have gone through the shock of regulatory overhaul. While investors may be confused with the China’s equity market prospects after the ripples, historical Price-to-Book (PB) valuations may provide a different perspective.

The PB ratio compares companies’ market price to their book value, which is the net asset value in their balance sheets. Over the past 30 years, whenever the PB ratio of Hang Seng Index (HSI) reached the lowest level at around 1x during various crises, it then demonstrated considerable rebound subsequently. Given HSI’s current PB ratio is at ~1x, we believe that the downside risk for Chinese equities is limited, and the chance of further significant drop stays remote.

Price-to-Book Value of Hang Seng Index

Source: Bloomberg, as of 9 Dec 2021

5. Can you summarize your Chinese equity outlook and investment strategy?

Overall, we are turning more positive on Chinese equities in 2022. Besides potential policy loosening looking ahead as mentioned above, we are also seeing other bright spots:

Effective pandemic control – We believe China’s zero tolerance towards COVID-19 may limit the impact of Omicron to its economy, relative to other economies.

Compelling valuation – China’s equity market (HSI at ~12x PE) is trading at an attractive discount compared to global and US market (S&P500 of 22x PE, NASDAQ 100 of ~30x PE)

While we are positive on Chinese equities as a whole, it is important to bear in mind that identifying the sectors/ stocks that can benefit from China’s long-term structural growth would be key:

- Stocks that can benefit from the long-term domestic consumption uptrend (i.e. well established sportswear brands)

- High-end manufacturing sectors that are in-line with China’s strategic goal of self-reliance, such as semiconductors, 5G and AI

- Clean energy related sectors, with China’s plan to achieve net-zero emission by 2060. Examples include renewable energy manufacturers and new energy vehicles producers.

Disclaimer

The content is prepared by Hang Seng Investment Management Limited (“HSVM”) and is for reference only. At the time of publication of the content, certain information of the content is obtained and prepared from sources which HSVM believes to be reliable, and HSVM does not warrant, guarantee or represent the accuracy, validity or completeness of such information. Under no circumstances shall the content constitute a representation that it is correct as of any time subsequent to the date of publication. HSVM reserves the right to change the content without notice. The content is the view of HSVM and does not constitute and should not be regarded as an offer or solicitation to anyone to invest into any investment product. Investors should read the relevant investment product’s offering document (including the full text of the risk factors and charges stated therein) before making any investment decision. Investment involves risks (including the risk of loss of capital invested), prices of investment product units may go up as well as down, past performance is not indicative of future performance. If investors have any doubt about the content or investment product (including its offering document), they should seek independent professional financial advice. HSVM will not be liable to anyone for any cost, claims, fees, penalties, loss or liability incurred if the content is improperly used.

The investment products managed by HSVM may invest in or adopt investment strategy similar or the same to those mentioned in the content.

The content shall not be duplicated or stored or distributed or “Hang Seng Investment Management Limited”, “恒生投資管理有限公司”, “恒生投資管理” , “恒生投資” or any marks containing these names shall not be used without the prior written consent of HSVM.

HSVM and Hang Seng Indexes Company Limited and other index companies (collectively “Index Companies”) are separate and independent entities, HSVM’s views and opinions do not represent the views or opinions of the Index Companies and HSVM cannot influence Index Companies on any matter.

The content has not been reviewed by the Securities and Futures Commission.

Investment involves risk and past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. The website has not been reviewed by SFC. Issued by Hang Seng Investment Management Limited.