Key Insights:

The first quarter of 2021 had a roller coaster ride across global markets. The year first began with optimism in equities, followed by market volatility amid the surge in bond yields. As a pulse check, most equity markets managed to end the quarter in the positive territory, while bonds posted mild, negative returns. How should investors buckle up for the volatility ride? Below are some questions that are recently asked by our investors.

Is the current level of bond yields sustainable?

Looking ahead, economic data will be key to gauge on the bond yield trend. I won’t be surprised to see bond yields going higher if the market sees economic data surprise on the upside, paving way for a stronger economic recovery in the US.

In fact, Biden’s USD 3 trillion fiscal stimulus package is quite encouraging, aiming at advancing a longer term economic agenda that would be partially, if not all, financed from tax increases on the corporations and the rich. While inflation is unlikely to jack up, the market might react positively to the development and lead to a continued increase in bond yields.

To put things into perspective, I see the recent bond yield surges as a normalization after a period of excessively low yields. The current levels are back to the point just before February 2020 – as if the pandemic hasn’t happened. Equity investors also took it as an excuse to take profits, after a significant rally in late 2020. Global economies have just crawled out from a downturn and the recovery is still at a nascent stage.

US 10-year treasury yield

Source: Bloomberg, as at 19 Mar 2021

When will the Fed start monetary tightening and taper on asset purchases?

Interest rates are likely to remain low for a prolonged period of time. The two data that the Fed monitors closely are average inflation and full employment. An average of 2% inflation means inflation can sometimes go higher or lower than 2%. I don’t see an immediate concern with current CPI at around 1.7%. Full employment means ~4% unemployment rate. With unemployment rate of ~6% at the moment, the tightening will unlikely to happen anytime soon.

There will still have some time before the Fed starts to taper on the asset purchases. The Fed repeatedly mentioned that the timing will depend on economic data. With supporting the economy being the first priority – even if the tapering cycle begins – the approach is unlikely to be hawkish or aggressive.

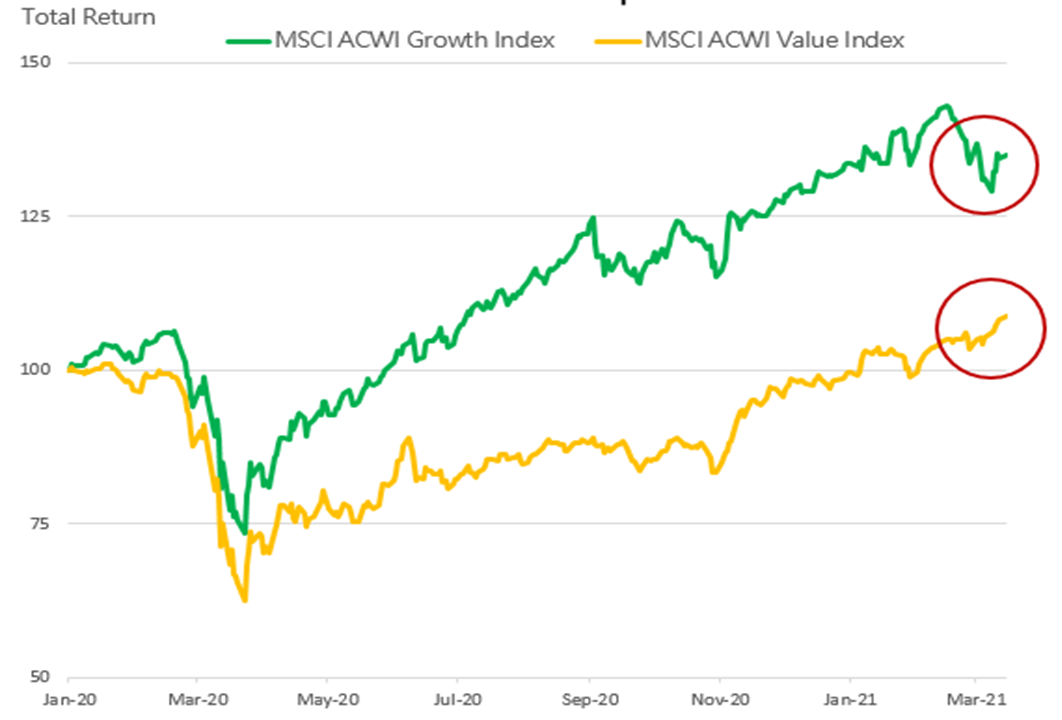

Growth vs. Value stocks performance

Source: Bloomberg, as at 15 Mar 2021

Will China revert to a tightening monetary bias?

As compared to other developed markets, China has not been aggressively loosening its monetary policies. In fact, China’s RRR has not be reduced since Jan 2020, given the country was the first to recover from an economic downturn. The key is, I believe the Chinese government has plenty of bullets to relax policies if needed.

What’s your view on growth and value stocks?

Growth stocks were by far the performance winner last year. Since mid-February, I saw a style rotation shifting to value stocks. What is worth noting that the fundamentals of quality growth stocks have not changed, and valuations are now more reasonable with the recent pullback. This year, I believe the performance divergence between growth and value stocks will narrow and the overall performance contribution will be more equally spread out.

Where do you see opportunities for bonds? What about Investment Grade (IG) vs High Yield (HY) bonds?

For bonds, I see attractive opportunities in the Asian space. Asia still offers higher yields than other developed markets. Between IGs and HYs, I believe high quality HY bonds can benefit more from an economic recovery amid credit spread narrowing.

With the potential of the yield curve to further steepen, I prefer to use a short duration strategy. That said, once the situation stabilizes, my team may look for long-dated bonds to capture attractive yield opportunities. We would monitor the market closely.

How to capture opportunities without exposing to excessive risks?

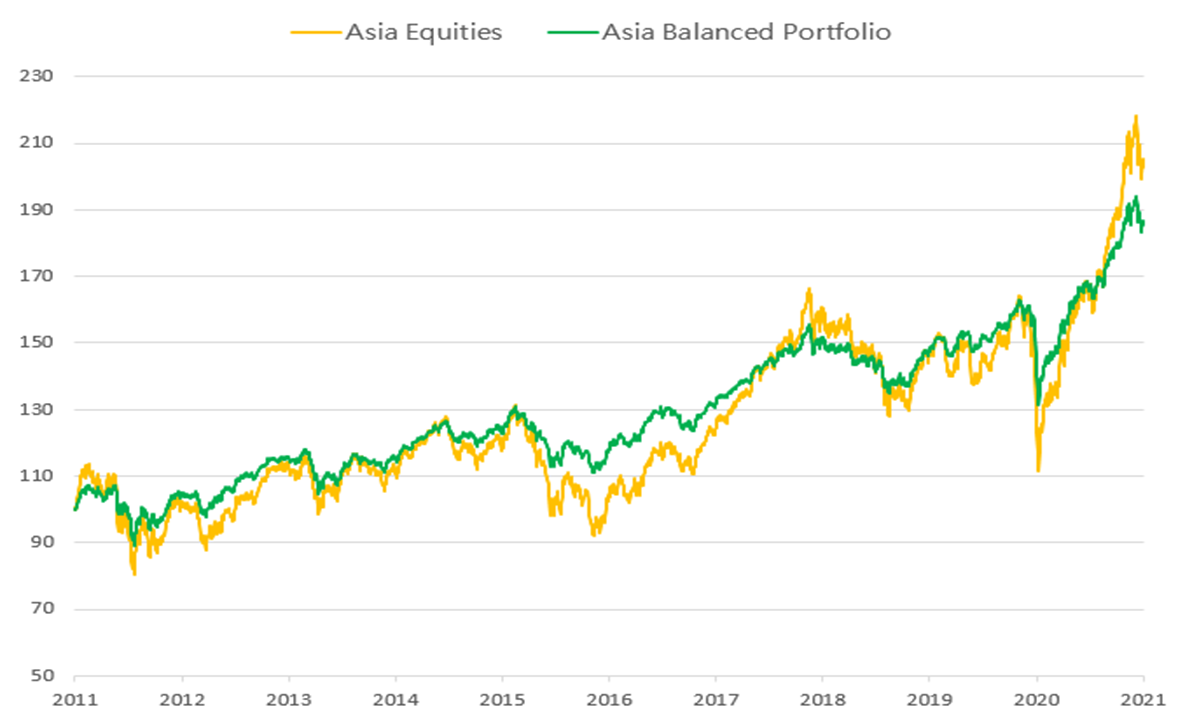

What I’m seeing now is that the daily market fluctuations are getting higher than before, as compared to the pre-COVID days. I believe a balanced approach, with a combination of equities and bonds, would bode well amid the current market volatility while offering a better risk-adjusted return potential.

| Asia Balanced Portfolio | Asia Equities | |

Annualised Return (Past 10-year) |

6.2% | 7.0% |

Annualised Volatility (Past 10-year) |

9.4% | 15.7% |

Source: Bloomberg, as at 15 Mar 2021.

*Asia Equities refers to MSCI Asia Pacific (ex-Japan) Index; Asia Balanced Portfolio refers to 50% MSCI Asia Pacific (ex-Japan) Index with 50% JPM Asia Credit Composite Index.

Comparing an Asia balanced strategy (50% equities and bonds) with a pure Asian equity strategy, the balanced strategy’s annualized 10-year return is 0.8% less than a pure equity strategy, but the volatility is significantly less – having only 60% of the pure equity strategy’s volatility. This is a result of including bonds which can effectively reduce volatility. At the same time, bonds can offer yield opportunities, while equity exposure can provide pockets of growth and dividend yield opportunities.

Asian balanced portfolio offers comparable return with lower volatility

Source: Bloomberg, as at 15 Mar 2021

*Asia Equities refers to MSCI Asia Pacific (ex-Japan) Index; Asia Balanced Portfolio refers to 50% MSCI Asia Pacific (ex-Japan) Index with 50% JPM Asia Credit Composite Index.

Disclaimer

The content is prepared by Hang Seng Investment Management Limited (“HSVM”) and is for reference only. At the time of publication of the content, certain information of the content is obtained and prepared from sources which HSVM believes to be reliable, and HSVM does not warrant, guarantee or represent the accuracy, validity or completeness of such information. Under no circumstances shall the content constitute a representation that it is correct as of any time subsequent to the date of publication. HSVM reserves the right to change the content without notice. The content is the view of HSVM and does not constitute and should not be regarded as an offer or solicitation to anyone to invest into any investment product. Investors should read the relevant investment product’s offering document (including the full text of the risk factors and charges stated therein) before making any investment decision. Investment involves risks (including the risk of loss of capital invested), prices of investment product units may go up as well as down, past performance is not indicative of future performance. If investors have any doubt about the content or investment product (including its offering document), they should seek independent professional financial advice. HSVM will not be liable to anyone for any cost, claims, fees, penalties, loss or liability incurred if the content is improperly used.

The investment products managed by HSVM may invest in or adopt investment strategy similar or the same to those mentioned in the content.

The content shall not be duplicated or stored or distributed or “Hang Seng Investment Management Limited”, “恒生投資管理有限公司”, “恒生投資管理” , “恒生投資” or any marks containing these names shall not be used without the prior written consent of HSVM.

HSVM and Hang Seng Indexes Company Limited and other index companies (collectively “Index Companies”) are separate and independent entities, HSVM’s views and opinions do not represent the views or opinions of the Index Companies and HSVM cannot influence Index Companies on any matter.

The content has not been reviewed by the Securities and Futures Commission.

Investment involves risk and past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. The website has not been reviewed by SFC. Issued by Hang Seng Investment Management Limited.