Key Insights:

- The undesirable performance of Chinese equities was mainly affected by global and China specific risk factors.

- We believe the worst time for the Chinese property sector is likely over, but we may see volatility/ news flows on individual companies from time to time.

- We are less bearish on internet segments, such as online gaming, and we believe the regulatory headwinds have already passed the worst period.

- While 2Q will likely to be hovering in a trading range, we believe there is a possibility for Chinese equities to turnaround in 2H 2022.

- Amid global uncertainties, we recommend investors to stay nimble and focus on quality bonds with shorter duration, balanced funds, or passive/ active equity funds, depending on risk appetite and needs.

Most equity and bond markets globally struggled in the negative territories in the first quarter of 2022 amid various global uncertainties, such as geopolitical ramifications between Ukraine and Russia, as well as US Fed rate/ tapering on the back of rising inflationary pressures. Locally in Asia, Chinese equities were by far the worst performing markets year-to-date. What should investors expect looking ahead in 2H 2022 and how should they navigate amid the recent volatility? The five questions below may shed more light.

1. Why did Chinese equities not perform well?

Chinese equities were the worst performing markets in Q1 2022. Contrary to what we originally expected, the recent performance of Chinese equities, particularly in the offshore space, was dampened by volatilities arising from dual factors – global and China specific.

Global factors include the stirred up on the geopolitical tension between Russia and Ukraine, as well as the lingering concerns on Fed rate hikes and tapering. China specific factors include Chinese ADR delisting concerns (though the Chinese government allows US to access the audit papers which lessens the worries from the market), rebound of COVID cases, and potential regulatory risks.

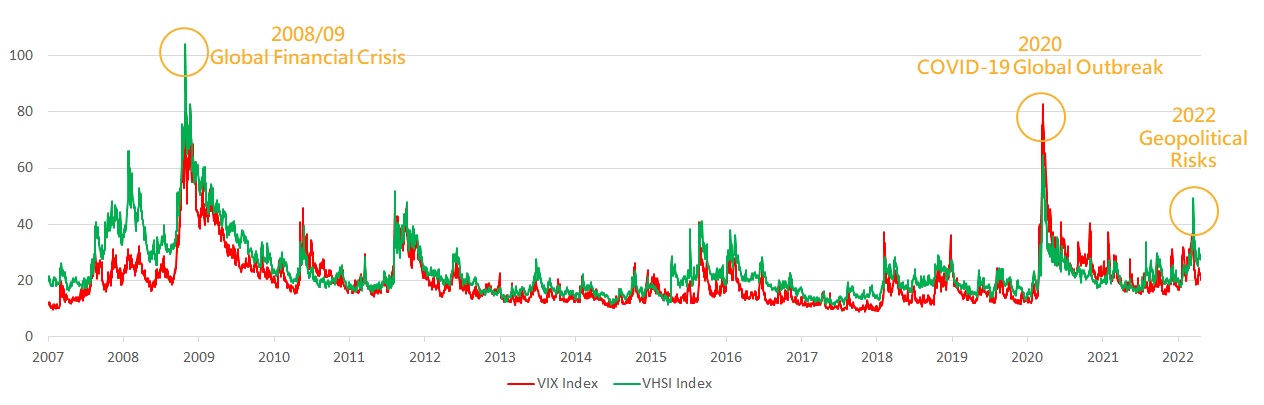

To take a pulse check of the investors’ risk appetite on equities, we can look into VIX1 and VHSI2, as popular measures of the US and Hong Kong stock markets’ expectation on market volatility respectively. The higher the VIX and VHSI values, the more worries from the market and the lower is the risk appetite. The recent values in VIX revealed that the volatility has fallen back to a relatively lower level, implying that investors have digested the negative news in the US stock market. VHSI values, however, are slightly higher, taking into account of the China specific risks amid the recent COVID lockdowns in different parts of mainland China.

1 VIX refers to the Chicago Board Options Exchange's CBOE Volatility Index, which measures the expected volatility of the S&P 500 Index.

2 VHSI refers to the HSI Volatility Index, which measures the expected volatility of the Hang Seng Index.

VIX and VHSI Index

Source: Bloomberg, HSVM, as of 20 Apr 2022

2. What is your take on property crackdown for bonds?

The Chinese government recognized the importance of the property market and we saw a series of measures from the government to alleviate the sector. We believe the worst time for this sector is likely over, but we may see volatility/ news flows on individual companies from time to time, as the sector is still at the bottom of the “U” shape recovery.

Currently, some property developers are in financial stress and their bond prices have been priced at a high likelihood of default. Moreover, offshore issuers are expected to face further stress to repay maturing debts in the upcoming quarters. Although newsfeeds on certain positive measures have surfaced in the past few months, it still remains in the fine-tuning stage and the effect would be highly-dependent on the execution at local government level.

The team has been particularly selective when choosing bonds in the property sector. While we believe that some quality developers (with attractive valuations) may survive when the situation settles, our focus is on quality SOEs as these developers would offer higher visibility. Currently, we are underweighting the sector.

Mainland China’s Alleviation Policies on the Property Market:

- 10 Nov 2021 - Relax interbank bond issuance for some mainland property developers

- 10 Dec 2021 - Relax bond issuance for acquisitions in the property sector

- 7 Jan 2022 - Urge banks to boost property lending to developers

- 20 Jan 2022 - Draft new rules to allow property developers access pre-sale funds in escrow account easier

- 10 Feb 2022 - Require asset management firms to participate in the restructuring of weak developers

- 16 Mar 2022 - Suspend expansion of property tax reform pilot program

- 3 Apr 2022 - Relax property market regulations in 60+ cities

Source: HSVM, as of Apr 2022

3. Any contrarian view on Chinese equities?

Depending on the market recovery and external global uncertainties, we are less bearish on internet plays, as compared to market consensus. We believe the regulatory headwinds have already passed the worst period, and selective companies with strong management capabilities and execution may be able to adapt to the new regulatory environment.

In particular, we prefer selected internet segments such as online gaming, especially during the COVID lockdown where people are likely to spend more time and money on it. The recent approval of 45 domestic games, which ends the eight-month game approval suspension since Aug 2021, can also drive the online gaming momentum. Besides, the Asian Games to be held in September in Hangzhou will include e-Sports for the first time as an official game.

4. When will Chinese equities revive?

We expect Chinese equities to hover in a trading range over Q2 as there are a number of global and local uncertainties that are still lingering. While it is difficult to gauge exactly when Chinese equities will rebound, we believe the previous sell-off with Hang Seng Index (HSI) at 18,000 level has more or less bottomed. Depending on the economic recovery progress and market developments, we may see a turnaround in 2H 2022. Currently, HSI is trading at Price to Book (PB) ratio of 0.84x, which is lower than the periods of extreme market volatilities, such as the Asian and Global Financial Crisis.

Over a longer investment horizon, we believe Chinese equities will continue to offer a compelling risk-reward opportunity, as justified by current valuations and earnings growth prospects.

Hang Seng Index Price-to-Book Ratio

Source: Bloomberg, HSVM, as of 20 Apr 2022

5. How should investors position amid the global uncertainties?

Investors should remain flexible in navigating today’s dynamic market environment. Depending on the risk appetite of investors, we suggest the below investment strategies and asset classes for consideration:

Conservative investors can consider quality bonds with shorter duration, as they are less sensitive to interest rate hikes. In addition, the 2 year US treasury yield is already at 2.68% (as at 21 Apr 2022), which is an attractive yield given its low risk.

For medium risk investors, balanced funds, with both equity and bond sleeves, can offer a stable income source with lower volatility while capturing potential growth potential at the same time. Focusing on regional markets, rather than a single market, may also offer diversification. In particular, Asian markets are generally less affected by high inflation and Ukraine/ Russia geopolitical risks. Singaporean and Indonesian equities fared well so far this year, as defensive markets that benefitted from re-opening post-COVID.

More aggressive investors can take advantage of market weakness and volatilities amid uncertainties to ride through the volatilities and potentially benefit from equity funds, including passive or active equity funds. Passive fund investors can capture market return (beta) in a more convenient way with relatively lower cost. Active fund investors can consider investing in core investment themes with secular growth drivers. Though the short term performance may be volatile, investors should be prepared to ride through the short-term volatile swings and potentially benefit from the longer-term, structural growth potential.

Disclaimer

The content is prepared by Hang Seng Investment Management Limited (“HSVM”) and is for reference only. At the time of publication of the content, certain information of the content is obtained and prepared from sources which HSVM believes to be reliable, and HSVM does not warrant, guarantee or represent the accuracy, validity or completeness of such information. Under no circumstances shall the content constitute a representation that it is correct as of any time subsequent to the date of publication. HSVM reserves the right to change the content without notice. The content is the view of HSVM and does not constitute and should not be regarded as an offer or solicitation to anyone to invest into any investment product. Investors should read the relevant investment product’s offering document (including the full text of the risk factors and charges stated therein) before making any investment decision. Investment involves risks (including the risk of loss of capital invested), prices of investment product units may go up as well as down, past performance is not indicative of future performance. If investors have any doubt about the content or investment product (including its offering document), they should seek independent professional financial advice. HSVM will not be liable to anyone for any cost, claims, fees, penalties, loss or liability incurred if the content is improperly used.

The investment products managed by HSVM may invest in or adopt investment strategy similar or the same to those mentioned in the content.

The content shall not be duplicated or stored or distributed or “Hang Seng Investment Management Limited”, “恒生投資管理有限公司”, “恒生投資管理” , “恒生投資” or any marks containing these names shall not be used without the prior written consent of HSVM.

HSVM and Hang Seng Indexes Company Limited and other index companies (collectively “Index Companies”) are separate and independent entities, HSVM’s views and opinions do not represent the views or opinions of the Index Companies and HSVM cannot influence Index Companies on any matter.

The content has not been reviewed by the Securities and Futures Commission.

Investment involves risk and past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. The website has not been reviewed by SFC. Issued by Hang Seng Investment Management Limited.